When tax season rolls around, many South Africans feel some confusion and stress. SARS expects a provisional payment, but how do you know exactly that how much to pay ? The good news is that it’s not as complicated as it seems. With the right steps, you can confidently and positively calculate your first provisional tax payment and avoid byself from the penalties.

This guidance breaks it down into simple and actionable steps so you’ll know exactly what to do.

Step 1 : Estimate Your Taxable Income

First step is to realistic estimate of how much income you’ll earn for the entire tax year (1 March 2025 to 28 February 2026).

This includes :

- Salary or wages

- Freelance or gig work

- Rental income

- Investment returns (interest, dividends, etc.)

- Business or side earnings

Important : Don’t confuse with total income and taxable income. SARS only taxes you on your profit, means your income after deducting justifiable business expenses.

What counts as tax deductible expenses ?

- Fuel for business travel

- Internet / data for client projects

- Professional tools, equipments and softwares used to earn for income

🚫 What things doesn’t count ? Personal spending like dinners, new “home / office” coffee machine or any lifestyle expenses not directly related to earning income.

If you submitted a return last year and your income hasn’t varied, you can use your basic amount (from your last assessment). However, if that figure is older than 18 months, SARS requires you to increase it by 8% per year.

Step 2 : Calculate Your Annual Tax

Once you’ve estimated taxable income, it’s time to work out how much tax you’ll owe for the year.

You can do this with two ways :

- Use the SARS tax tables

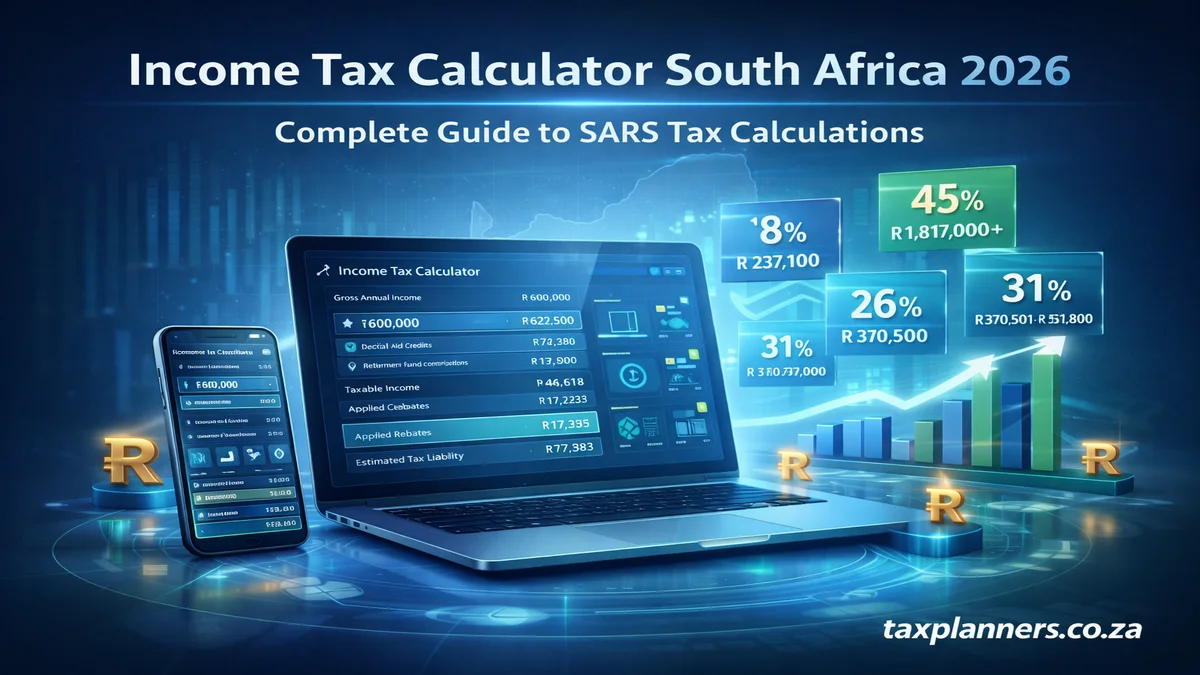

- Try an online calculator like www.TaxPlanners.co.za free tool

When calculating, don’t forget about tax rebates :

- Everyone is entitled for the primary rebate.

- Over 65 or 75 taxpayers receive additional rebates.

These rebates reduce the total tax that you owe, so always apply them before finalizing it.

Step 3 : Split It In Half

SARS doesn’t expect from you to pay everything upfront. For your first provisional tax payment due on dated 29-August-2025), you need to pay half of your estimated annual tax liability.

Formula :

Estimated annual tax ÷ 2 = Provisional tax due (before deductions)

Step 4 : Deduct PAYE And Other Taxes Already Paid

If you’re employed, your company deducts PAYE (Pay As You Earn) tax every month. This amount reduces what you owe in provisional tax.

Here’s what to subtract :

- Total PAYE deducted from March to August

- Any foreign tax already paid (if applicable)

Step 5 : The Amount Left = What You Owe

After deducting PAYE (Pay As You Earn) and other credits, the remaining amount is your first provisional tax payment.

Even if the result is zero or very small, still you must submit your IRP6 return. SARS requires it, regardless of whether a payment is due or not.

Example Calculation

Let’s say:

- Estimated annual income : R 220,000/-

- Tax before rebate : R 39,600/-

- Minus primary rebate : R 17,235/-

- Tax payable for year : R 22,365/-

Now divide in half :

- Provisional tax (first half) : R 11,182.50/-

Subtract PAYE already paid:

- PAYE paid (March–August) : R 10,000/-

➡ Amount due now : R 1,182.50/-

Why It’s Important to Pay on Time

Paying and submitting your IRP6 on time helps you avoid :

- 10% late payment penalties

- Daily interest on unpaid balances

- 20% underestimation penalties if your declared income is unrealistically low

Remember : SARS isn’t trying to baffle you, only they want to stay on track so you don’t face a massive bill at the end of year.

Need Help ?

Still you feels it is devastating, don’t stress on yourself. Tools like www.taxplanners.co.za and other SARS approved platforms can walk you through the process step by step — To ask simple questions, doing the calculations for you, and even submitting directly to SARS.

For accurate tax planning and instant calculations, don’t forget to explore our complete suite of Pay Calculators designed to help you calculate taxes, refunds, loans, and retirement figures with confidence.