Introduction

Paying taxes is a responsibility for every South African, but to understand how much exactly you owe or how much refund you are eligible for sometimes can feel confusing. With changing SARS regulations and annual tax updates, it’s easy to make mistakes or miss out on deductions.

That’s where our Income Tax Calculator South Africa 2025 is available. This tool is free, easy to use and helps you quickly estimate your tax liability, check potential refunds, and plan your finances more efficiently. Whether you are a salaried employee, freelancer, or small business owner, this calculator is designed to give you accurate results in just a few clicks.

With this guide, you’ll not only learn how to use the calculator effectively but also understand the tax brackets, to avoid common mistakes, and tips to maximize your refund.

Understanding South African Tax Brackets in 2025

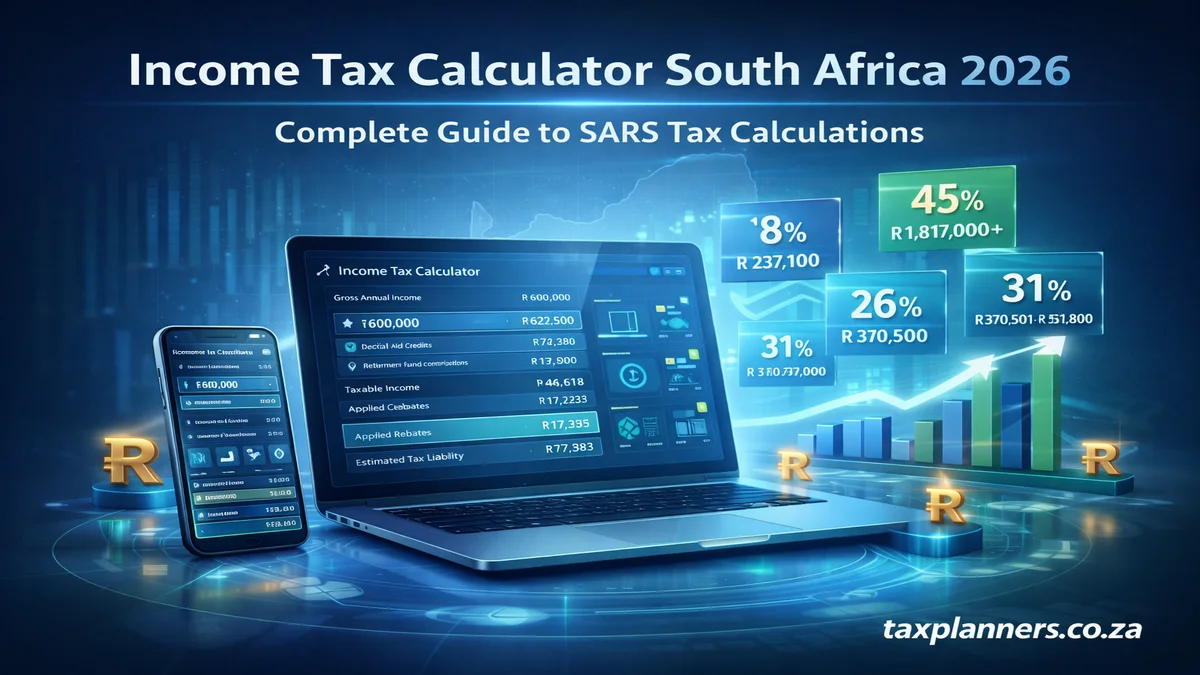

South Africa uses a progressive tax system, the more you earn, the higher your tax rate. Below is a simplified version of the tax brackets for 2025:

| Annual Income (ZAR) | Tax Rate (%) |

|---|---|

| 0 – 237,100 | 18% |

| 237,101 – 370,500 | 26% |

| 370,501 – 512,800 | 31% |

| 512,801 – 673,000 | 36% |

| 673,001 – 857,900 | 39% |

| 857,901 – 1,817,000 | 41% |

| 1,817,001 + | 45% |

Key Takeaways :

- If your annual income is below ZAR 237,100, you pay only 18% tax.

- Deductions and contributions (medical aid, retirement funds) reduce your taxable income.

- Knowing your bracket is essential for accurate tax planning.

How Our Income Tax Calculator Works

Income Tax Calculator South Africa 2025 is easy to use. Please follow these following steps :

- Enter Your Annual Income – Enter your basic salary, bonuses, and any freelance income.

- Add Deductible Expenses – Such as retirement contributions, medical aid, or Unemployment Insurance Fund (UIF)

- Click Calculate – Instantly see your estimated PAYE, total tax owed, and possible refund.

Our calculator also shows a breakdown of each tax component, helping you understand exactly where your money goes.

Pro Tip : Always cross check your input values, especially to ensure your deductions accuracy.

Avoid Common Tax Mistakes

Most of the South Africans overpay or underpay taxes due to the simple errors. Be aware these common blunders :

- Missing Deductions : Ensure that all eligible deductions like retirement contributions and medical aid payments are included.

- Incorrect Filing Status : Filing as an individual or married couple can affect on your tax rate.

- Ignoring Bonuses and Freelance Income : These should be included in your total income.

- Not Updating Changes Mid Year : Promotions, increase in salary or new allowances should be updated in your calculations.

By using a reliable calculator like ours, you can reduce the risk of these type of mistakes.

Tips to Maximize Your Refund

If you follow these strategies then it’s easier to get tax refund :

- Claim All Eligible Deductions : Contributions to retirement funds, medical aid and charitable donations are deductible.

- Keep Accurate Records : Receipts for expenses and medical claims help for your refund claims.

- Use Retirement Contributions Wisely : Investing in retirement funds not only saves tax but also benefits for your future finances.

- File Early : By filing your tax return on time to avoid penalties and interest.

With our calculator, you can check different scenarios to see how adjustments affect your on refund.

Frequently Asked Questions (FAQ)

Q1 : How do I calculate my PAYE in South Africa ?

Answer : PAYE (Pay-As-You-Earn) is calculated based on your annual income and tax bracket. Our calculator automatically estimates PAYE after considering all deductions and taxable components.

Q2 : Can I use this calculator for provisional tax ?

Answer : Yes, You can input your estimated income for the year, and the calculator will give you an approximation of the tax you might owe.

Q3 : How accurate is the tax calculator ?

Answer : While our calculator is highly accurate based on SARS rules for 2025, it is always recommended to consult a professional accountant for complex situations.

Call-to-Action

Ready to find out how much tax you’ll pay or what refund you can expect ?

Try the Income Tax Calculator South Africa 2025 now!

It’s free, fast, and easy to use, no complex forms, just accurate results in seconds.

Conclusion

Doesn’t have to be stressful just understand your taxes in South Africa. With the Income Tax Calculator South Africa 2025, you can:

- Quickly estimate your tax liability

- Check your potential refund

- Avoid common mistakes

- Plan your finances comprehensively

Use our calculator and take the first step toward smart tax planning in South Africa!