Navigating South Africa’s tax system can feel overwhelming, but understanding how to calculate your income tax correctly is crucial for every taxpayer. Whether you’re a salaried employee, freelancer, or business owner, knowing your tax obligations helps you avoid penalties and make informed financial decisions.

This comprehensive guide will walk you through everything you need to know about income tax calculations in South Africa for the 2026 tax year, including the latest SARS tax tables, deductions, rebates, and how to use an income tax calculator effectively.

Understanding South Africa’s Income Tax System

The South African Revenue Service (SARS) operates a progressive tax system, meaning the more you earn, the higher percentage of tax you pay on portions of your income. This system is designed to ensure fairness, with lower earners paying proportionally less tax than higher earners.

Who Must Pay Income Tax in South Africa?

You’re required to register as a taxpayer and pay income tax if you’re:

- A South African resident earning income above the tax threshold

- A non-resident earning South African-sourced income

- Self-employed with annual income exceeding R350,000

- An employee whose employer deducts Pay-As-You-Earn (PAYE)

- A company or trust operating in South Africa

The current tax threshold for the 2025/2026 tax year means you only start paying tax if your annual income exceeds certain amounts based on your age group.

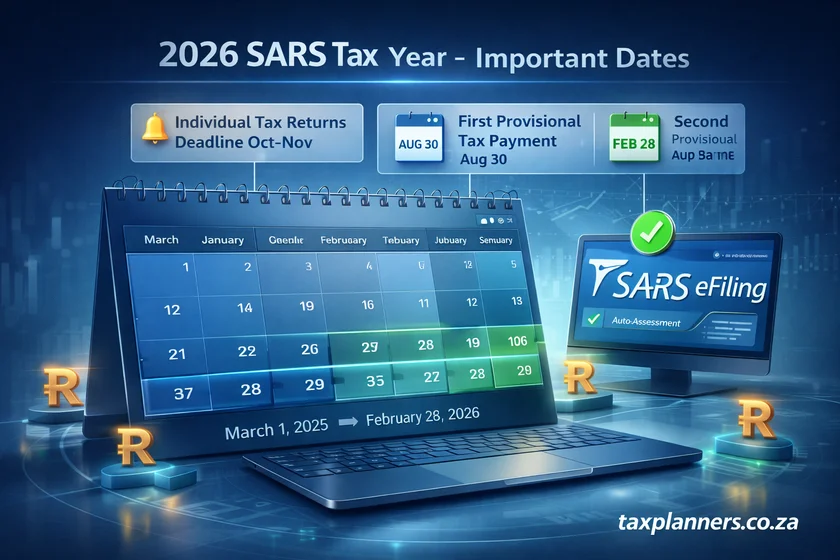

2026 Tax Year: Key Dates and Deadlines

Understanding the South African tax year is essential for proper planning:

- Tax Year Period: March 1, 2025 to February 28, 2026

- Individual Tax Returns: Deadline typically in October/November 2026

- Provisional Tax Payments: Two payments during the tax year (August and February)

- Auto-Assessment: SARS may auto-assess certain taxpayers

Always verify current deadlines on the SARS eFiling platform as dates may vary.

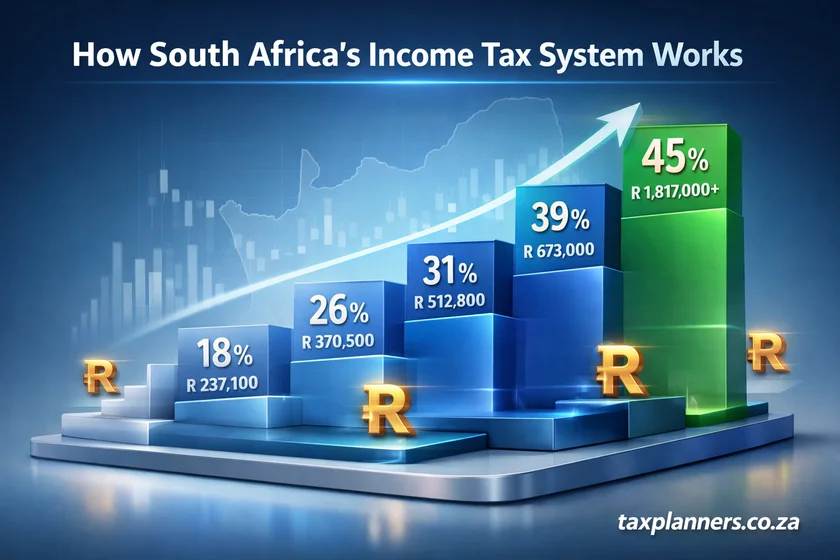

South African Income Tax Rates for 2026

The income tax brackets determine how much tax you pay based on your taxable income. Here are the current tax rates:

Individual Tax Rates (2025/2026 Tax Year)

For individuals under 65 years:

| Taxable Income (ZAR) | Tax Rate | Base Tax | Tax on Excess |

|---|---|---|---|

| R0 – R237,100 | 18% | R0 | 18% of taxable income |

| R237,101 – R370,500 | 26% | R42,678 | 26% of income above R237,100 |

| R370,501 – R512,800 | 31% | R77,362 | 31% of income above R370,500 |

| R512,801 – R673,000 | 36% | R121,475 | 36% of income above R512,800 |

| R673,001 – R857,900 | 39% | R179,147 | 39% of income above R673,000 |

| R857,901 – R1,817,000 | 41% | R251,258 | 41% of income above R857,900 |

| R1,817,001 and above | 45% | R644,489 | 45% of income above R1,817,000 |

Tax Rebates for 2026

Tax rebates reduce your actual tax liability. The primary, secondary, and tertiary rebates are:

- Primary Rebate (all taxpayers): R17,235 per year

- Secondary Rebate (taxpayers 65-74 years): Additional R9,444

- Tertiary Rebate (taxpayers 75+ years): Additional R3,145

These rebates mean that if you’re under 65, you effectively don’t pay tax on the first R95,750 of income. For those aged 65-74, the threshold increases to R148,217, and for those 75 and older, it’s R165,689.

How to Calculate Your Income Tax in South Africa

Calculating your income tax involves several steps. Let’s break down the process:

Step 1: Determine Your Gross Income

Your gross income includes all earnings before any deductions:

- Salary and wages

- Bonuses and commissions

- Rental income

- Interest and dividends

- Business profits

- Foreign income (if applicable)

- Pension and annuity income

Step 2: Calculate Allowable Deductions

Certain expenses can be deducted from your gross income to arrive at your taxable income:

Common Tax Deductions:

- Retirement Contributions: Up to 27.5% of taxable income or R350,000 (whichever is lower)

- Medical Aid Contributions: Tax credits apply – R364 per month for main member, R364 for first dependent, R246 for additional dependents

- Travel Allowance: Business-related travel expenses

- Home Office Expenses: If you work from home (specific criteria apply)

- Donations: Up to 10% of taxable income to registered public benefit organizations

Step 3: Apply the Tax Tables

Once you have your taxable income, apply the appropriate tax bracket:

Example Calculation:

Let’s say you’re 35 years old with a taxable income of R500,000 per year.

- Your income falls in the R370,501 – R512,800 bracket

- Base tax: R77,362

- Tax on excess: (R500,000 – R370,500) × 31% = R129,500 × 0.31 = R40,145

- Total tax before rebate: R77,362 + R40,145 = R117,507

- Less primary rebate: R117,507 – R17,235 = R100,272 annual tax

- Monthly tax: R100,272 ÷ 12 = R8,356 per month

Step 4: Consider Tax Credits

Medical aid tax credits are applied after calculating your tax liability, further reducing what you owe.

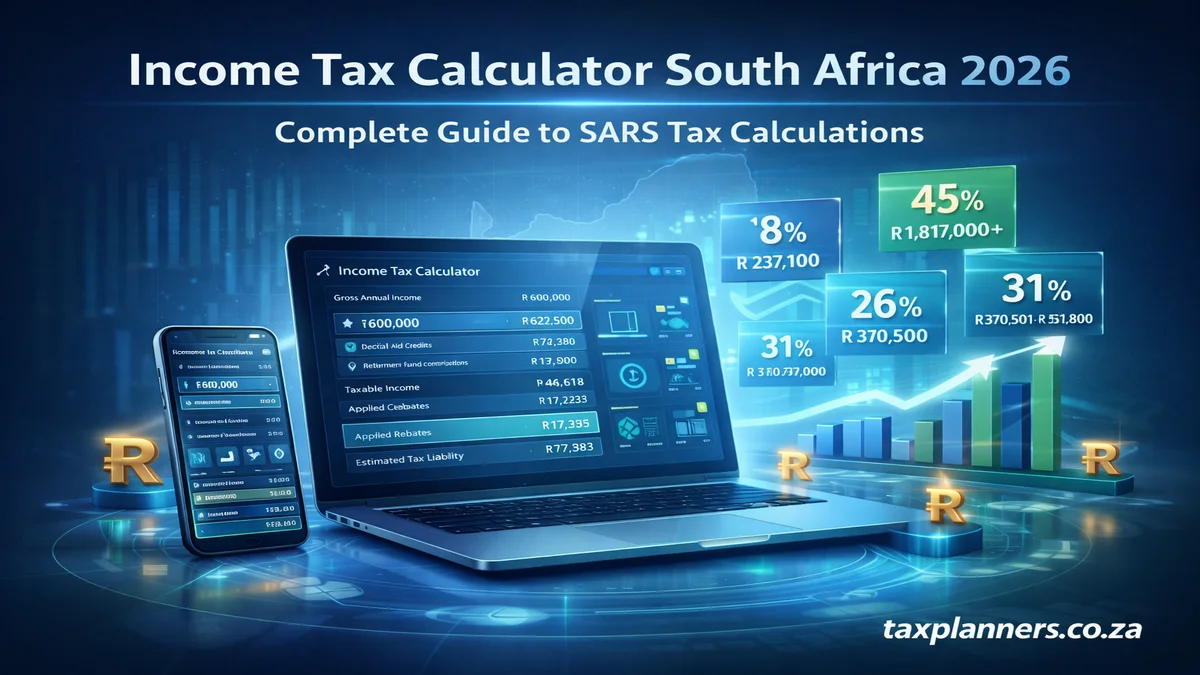

Using an Income Tax Calculator for South Africa

An income tax calculator simplifies the complex calculation process. Here’s how to use one effectively:

Benefits of Using a Tax Calculator

- Accuracy: Eliminates mathematical errors in manual calculations

- Time-Saving: Instant results instead of lengthy calculations

- Planning Tool: Test different scenarios (bonuses, retirement contributions)

- Updated Rates: Good calculators reflect current SARS rates and thresholds

- PAYE Verification: Check if your employer is deducting the correct amount

What Information You’ll Need

To use an income tax calculator, gather:

- Annual gross salary or monthly salary

- Bonus payments and commission

- Medical aid contributions

- Number of dependents on medical aid

- Retirement fund contributions

- Age (for rebate purposes)

- Other income sources

Top Features of a Quality Tax Calculator

Look for calculators that offer:

- Monthly and annual calculation options

- Medical aid tax credit calculations

- Retirement contribution optimization

- Comparative analysis (before and after deductions)

- Take-home pay calculations

- Tax bracket visualization

- Downloadable reports

PAYE (Pay-As-You-Earn) Explained

PAYE is the system through which employers deduct income tax from employees’ salaries monthly and pay it directly to SARS.

How PAYE Works

- Your employer calculates your annual expected income

- They determine your tax bracket and applicable deductions

- Tax is deducted monthly from your salary

- Your employer submits this to SARS on your behalf

- You receive a payslip showing gross pay, deductions, and net pay

IRP5 and Tax Certificates

At the end of each tax year, your employer issues an IRP5 certificate showing:

- Total remuneration paid

- PAYE deducted

- Retirement fund contributions

- Medical aid contributions

- Other deductions and benefits

This document is crucial for completing your annual tax return.

Provisional Tax for Self-Employed Individuals

If you’re self-employed, a company director, or earn income outside of PAYE, you’ll likely need to pay provisional tax.

Who Must Pay Provisional Tax?

You’re required to register as a provisional taxpayer if:

- Your income from sources other than salary exceeds R30,000 annually

- You’re a company or trust

- You earn rental income, freelance income, or investment income

Provisional Tax Payment Dates

Provisional taxpayers make two payments during the tax year:

- First Payment: End of August (6 months into the tax year)

- Second Payment: End of February (at the end of the tax year)

A third voluntary payment can be made when filing your return to avoid penalties.

Calculating Provisional Tax

Estimate your total taxable income for the year and calculate the tax using current rates. You then pay this in two installments. If you underestimate significantly, SARS may impose penalties and interest.

Tax Deductions and How to Maximize Them

Strategic tax planning can significantly reduce your tax liability. Here are key deductions and how to optimize them:

Retirement Annuity Contributions

Contributing to a retirement annuity (RA) offers immediate tax benefits:

- Deductible up to 27.5% of taxable income

- Maximum deduction of R350,000 per year

- Reduces your current tax while building retirement savings

Example: If you earn R600,000 annually and contribute R165,000 (27.5%) to an RA, your taxable income drops to R435,000, potentially moving you to a lower tax bracket.

Medical Aid Tax Credits

Unlike deductions that reduce taxable income, medical aid tax credits reduce your actual tax liability:

- R364/month for the main member

- R364/month for the first dependent

- R246/month for each additional dependent

Additional credits apply for those 65+ and for qualifying medical expenses exceeding certain thresholds.

Travel Allowance Claims

If you receive a travel allowance, you can claim actual business kilometers:

- Keep a detailed logbook of business travel

- Calculate costs per kilometer (fuel, maintenance, insurance, depreciation)

- Claim the business portion when filing your return

- SARS provides a prescribed rate per kilometer (currently around R4.84/km for 2026)

Home Office Deductions

With remote work becoming common, home office deductions are increasingly relevant:

Requirements:

- You must work from home regularly (not occasionally)

- Have a dedicated workspace

- Your employment contract or business requires it

Claimable Expenses:

- Portion of rent or bond interest

- Electricity and water (proportional)

- Internet and phone costs (business portion)

- Office furniture and equipment (depreciation)

Calculate the percentage of your home used for business and apply this to eligible expenses.

Common Tax Mistakes to Avoid

Avoiding these errors will save you money and prevent SARS penalties:

1. Missing Filing Deadlines

Late submissions incur penalties. Set reminders and file early to avoid last-minute rushes.

2. Not Claiming Eligible Deductions

Many taxpayers don’t claim all available deductions:

- Retirement contributions

- Medical expenses

- Donations to PBOs

- Work-related expenses

3. Incorrect Medical Aid Information

Ensure your IRP5 reflects accurate medical aid contributions and dependent information.

4. Failing to Declare All Income

SARS receives third-party data. Undeclared income from banks, investments, or side businesses will be flagged.

5. Not Keeping Proper Records

Maintain documentation for at least five years:

- Payslips and IRP5 certificates

- Bank statements

- Receipts for deductible expenses

- Logbooks for vehicle claims

- Medical expense receipts

6. Ignoring SARS Correspondence

Respond promptly to SARS queries and audit requests. Ignoring them leads to estimates and penalties.

How to File Your Tax Return in South Africa

Filing your tax return has become simpler with SARS eFiling, but understanding the process is crucial.

Step-by-Step Filing Process

1. Register for eFiling

If you haven’t already, register on the SARS eFiling website using your ID number and contact details.

2. Gather Required Documents

Collect all relevant documents:

- IRP5/IT3(a) certificates

- Medical aid certificates

- Retirement annuity certificates

- Investment statements (IT3b for local interest, IT3c for foreign dividends)

- Rental income records

- Business financial statements (if self-employed)

3. Access Your Return

Log into eFiling and navigate to “Returns” > “File Return”. SARS may auto-populate certain fields based on third-party data.

4. Verify and Complete Information

Check auto-populated data for accuracy. Common sections include:

- Personal information

- Income from employment (IRP5)

- Allowances and deductions

- Local interest and dividends

- Medical aid contributions

- Retirement fund contributions

- Additional income

5. Claim Deductions

Ensure you claim all eligible deductions:

- Travel allowance expenses

- Home office costs

- Donations

- Additional medical expenses

6. Review and Submit

Carefully review all information before submitting. Once submitted, you’ll receive an acknowledgment.

7. Review Your Assessment

SARS will issue an assessment showing whether you owe tax or are due a refund. Review it carefully and query any discrepancies within 30 days.

Tax Refunds: What You Need to Know

If you’ve overpaid tax during the year, you’re entitled to a refund.

When You Might Get a Refund

Common scenarios include:

- Your employer over-deducted PAYE

- You made excess provisional tax payments

- You claimed significant deductions not factored into PAYE

- You contributed to retirement funds

- You changed jobs mid-year and tax wasn’t calculated correctly

Refund Timeline

SARS typically processes refunds within:

- Auto-assessments: 72 hours to 21 days

- Standard returns: 21 to 30 business days

- Complex returns or audits: Up to several months

How Refunds Are Paid

Refunds are paid directly into your nominated bank account. Ensure your banking details on eFiling are correct and updated.

Delayed Refunds

If your refund is delayed, possible reasons include:

- SARS verification process

- Outstanding returns from previous years

- Tax debt offsetting

- Audit or review process

- Incorrect banking details

You can track your refund status on eFiling or contact SARS directly.

Tax Planning Strategies for 2026

Proactive tax planning helps minimize your liability legally and ethically.

Timing Income and Deductions

- Defer Income: If possible, defer bonuses to a year when you’ll be in a lower bracket

- Accelerate Deductions: Make retirement contributions before year-end to maximize current year deductions

Maximize Retirement Contributions

Contributing the maximum 27.5% to retirement funds provides immediate tax relief while securing your future.

Example: Earning R500,000 and contributing R137,500 saves approximately R42,625 in tax (at 31% marginal rate).

Use Tax-Free Savings Accounts

While contributions aren’t tax-deductible, growth and withdrawals are completely tax-free:

- Annual limit: R36,000

- Lifetime limit: R500,000

- No tax on interest, dividends, or capital gains

Income Splitting for Couples

If one spouse earns significantly more, consider:

- Investing in the lower earner’s name to utilize their lower bracket

- Contributing to the lower earner’s retirement fund

- Structuring rental property ownership appropriately

Donate Strategically

Donations to registered PBOs are deductible up to 10% of taxable income. This reduces tax while supporting worthy causes.

Special Tax Considerations

Certain situations require special attention when calculating tax.

Foreign Income and Tax Credits

South African residents are taxed on worldwide income, but there’s an exemption for foreign employment income:

- First R1.25 million earned while working abroad for more than 183 days is exempt

- Requires proper documentation and proof of foreign employment

- Double taxation agreements may apply

Capital Gains Tax (CGT)

When you sell assets like property, shares, or collectibles:

- First R40,000 of capital gain is excluded annually

- Individuals include 40% of gains above exclusion in taxable income

- Companies include 80% of gains

Rental Income

Property owners must declare rental income:

- Deduct allowable expenses (rates, taxes, repairs, bond interest)

- Depreciation on fixtures may be claimed

- Keep detailed records of income and expenses

Cryptocurrency Taxation

SARS treats cryptocurrency as an asset:

- Trading profits are taxed as income

- Investment gains subject to CGT

- Keep records of all transactions, purchases, and sales

Frequently Asked Questions

Q: Do I need to file a tax return if I only earn a salary?

A: It depends. SARS may auto-assess you if your tax affairs are straightforward. However, if you have deductions to claim or additional income, you should file a return to ensure accuracy and potentially get a refund.

Q: How can I reduce my monthly tax deductions?

A: You can’t directly reduce PAYE, as it’s calculated based on your income. However, maximizing retirement contributions will reduce your taxable income, which your employer will factor into PAYE calculations if properly informed.

Q: What happens if I miss the tax filing deadline?

A: SARS imposes penalties for late filing – currently a percentage of your tax liability per month, up to 35%. File as soon as possible to minimize penalties.

Q: Can I claim tax back from previous years?

A: Yes, you can submit returns for up to five years retrospectively. If you’re owed refunds, you should do this promptly.

Q: How accurate are online tax calculators?

A: Reputable calculators using current SARS rates are generally accurate for straightforward situations. However, complex tax situations may require professional advice.

Q: Is tax calculated on gross or net income?

A: Tax is calculated on your taxable income, which is gross income minus allowable deductions (not your net/take-home pay).

Getting Professional Tax Help

While calculators and self-filing work for many taxpayers, certain situations warrant professional assistance:

When to Consult a Tax Professional

- You’re self-employed with complex business structures

- You have multiple income sources

- You’ve received foreign income

- You’re involved in property development or trading

- You’re facing a SARS audit

- Your tax affairs involve trusts or estate planning

- You want to implement sophisticated tax planning strategies

Types of Tax Professionals

- Tax Practitioners: Registered with SARS, can represent you in disputes

- Chartered Accountants (CAs): Comprehensive financial and tax advice

- Tax Consultants: Specialize in tax planning and strategy

- Financial Advisors: Holistic financial planning including tax efficiency

Costs vs. Benefits

Professional fees typically range from R1,500 to R10,000+ depending on complexity. The benefits often outweigh costs through:

- Maximized deductions and credits

- Avoided penalties and interest

- Time savings

- Peace of mind

- Strategic tax planning

Conclusion

Understanding and correctly calculating your income tax in South Africa is essential for financial health and legal compliance. While the progressive tax system may seem complex, breaking it down into manageable components makes it accessible.

Key takeaways for 2026:

- Know your tax bracket and applicable rates

- Utilize all available deductions and credits

- Consider using an income tax calculator for accuracy

- File your returns on time to avoid penalties

- Keep meticulous records of income and expenses

- Plan proactively to minimize tax liability legally

- Seek professional help when needed

By staying informed about current tax rates, understanding how to calculate your obligations, and leveraging available deductions, you can ensure you’re paying the right amount of tax – neither overpaying nor underpaying.

Remember that tax laws change regularly, so stay updated through SARS communications and consider subscribing to tax updates. Whether you use an online calculator, handle your own filing through eFiling, or work with a tax professional, the important thing is to approach your tax obligations proactively and with accurate information.

Start planning for the 2026 tax year today by reviewing your current situation, maximizing your retirement contributions, organizing your records, and familiarizing yourself with the latest SARS requirements. Your future financial self will thank you for the effort you put into proper tax management now.