Learn how to accurately calculate your take-home pay under the 2026 South African PAYE system — and use our free PAYE calculators for instant, accurate results.

Introduction

Every employee in South Africa wants to know one thing at the end of the month:

👉 “How much will I actually take home after tax and deductions?”

Understanding how PAYE (Pay-As-You-Earn) works helps you make smarter financial decisions — from salary negotiations to budgeting and tax planning.

This 2026 guide explains the latest SARS PAYE rules, deductions, and tax rates, so you can confidently calculate your net (take-home) salary in South Africa.

For quick and accurate calculations, try the PAYE Calculator on TaxPlanners.co.za.

What Is PAYE in South Africa?

PAYE stands for Pay-As-You-Earn, a system where employers deduct income tax from employees’ salaries each month and pay it directly to the South African Revenue Service (SARS).

Instead of paying tax once a year, your employer collects it gradually throughout the year, based on your income and tax bracket.

Your gross salary is what you earn before deductions.

Your net salary (or take-home pay) is what you receive after:

- PAYE tax

- UIF (Unemployment Insurance Fund)

- Retirement contributions (if applicable)

- Medical aid or other company-specific deductions

Key PAYE Components (2026)

1. Gross Salary

This includes your basic salary, bonuses, allowances (like housing or car allowance), and any taxable benefits.

2. Allowable Deductions

Before tax is calculated, certain deductions reduce your taxable income:

- Retirement annuity contributions – up to 27.5% of taxable income (capped at R350,000 annually)

- Medical aid contributions – supported by medical tax credits

- UIF contribution – 1% of your salary (capped at R177.12 per month)

3. Tax Rebates (2026)

Tax rebates reduce your total tax liability. For 2026, SARS kept the same rebate structure as the previous year:

| Rebate Type | Amount (2026) |

|---|---|

| Primary (below 65) | R17,235 |

| Secondary (65–74) | R9,444 |

| Tertiary (75+) | R3,145 |

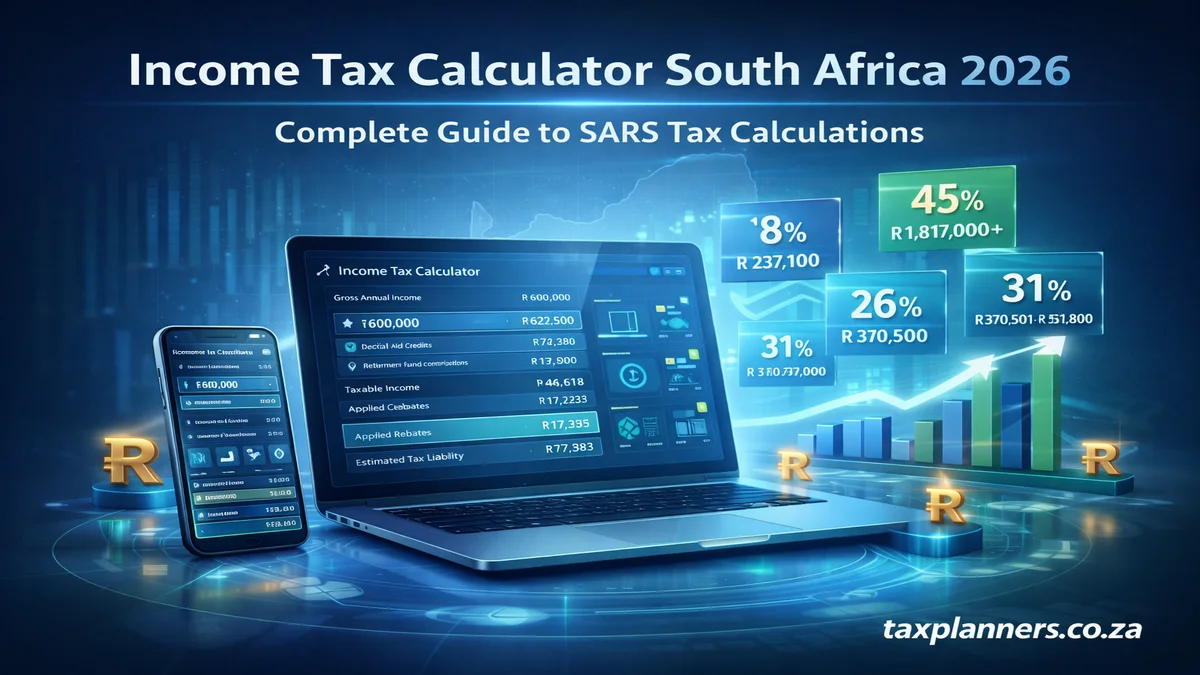

2026 South Africa PAYE Tax Rates

Applicable from 1 March 2025 to 28 February 2026:

| Taxable Income (per year) | Tax Rate (2026) |

|---|---|

| R1 – R237,100 | 18% of taxable income |

| R237,101 – R370,500 | R42,678 + 26% of income above R237,100 |

| R370,501 – R512,800 | R77,362 + 31% of income above R370,500 |

| R512,801 – R673,000 | R121,475 + 36% of income above R512,800 |

| R673,001 – R857,900 | R179,147 + 39% of income above R673,000 |

| R857,901 – R1,817,000 | R251,258 + 41% of income above R857,900 |

| R1,817,001 and above | R644,489 + 45% of income above R1,817,000 |

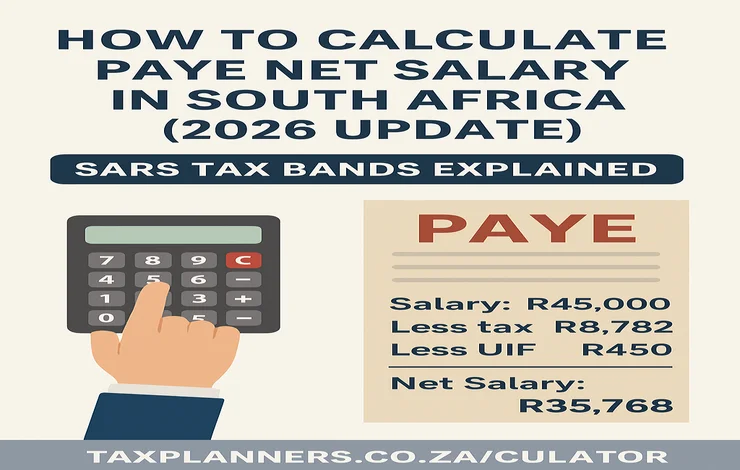

Step-by-Step Example: How to Calculate PAYE Net Salary (2026)

Employee Salary Details

- Gross monthly salary: R45,000

- Retirement contribution: R2,000/month

- UIF: 1% (R450)

- Medical aid: R2,500/month (for one adult, one child)

Step 1: Annualize Salary

R45,000 × 12 = R540,000 per year

Step 2: Subtract Deductions

Retirement annuity = R2,000 × 12 = R24,000

Taxable income = R540,000 – R24,000 = R516,000

Step 3: Apply PAYE Brackets

R516,000 falls in the R512,801–R673,000 band.

Tax = R121,475 + 36% × (R516,000 – R512,800)

= R121,475 + R1,152 = R122,627

Step 4: Subtract Primary Rebate

R122,627 – R17,235 = R105,392 annual PAYE

Step 5: Monthly PAYE

R105,392 ÷ 12 = R8,782/month

Step 6: Calculate Net Salary

Gross = R45,000

Less PAYE = R8,782

Less UIF = R450

Net Take-Home = R35,768/month

Want an exact result based on your salary, deductions, and dependents?

Use the South Africa PAYE & Net Salary Calculators on TaxPlanners.co.za — they apply all SARS 2026 tax tables automatically.

Why Your Take-Home Pay May Differ

Your real net salary depends on:

- Company-specific deductions (medical aid, pension, etc.)

- Bonuses or overtime income

- Medical aid tax credits for dependents

- Year-end adjustments or non-cash benefits

Always cross-check your payslip with SARS’s official tables or an online calculator to ensure accuracy.

Common PAYE Mistakes

❌ Confusing gross salary with take-home pay

❌ Ignoring UIF or pension deductions

❌ Using outdated PAYE tables

❌ Not applying tax rebates correctly

❌ Forgetting that bonuses affect annual taxable income

Final Thoughts

Understanding how to calculate PAYE net salary in South Africa (2026) helps you plan better, avoid underpayment issues, and stay SARS-compliant.

While you can calculate manually, using a reliable digital tool saves time and ensures precision.

👉 Try the TaxPlanners PAYE Calculator to get your exact 2026 net salary in seconds — fully updated for the latest SARS rules.