Selling property, shares, or other investments in South Africa? Understanding capital gains tax (CGT) before you sell can save you thousands of rands and prevent unpleasant surprises from SARS. Whether you’re disposing of a second property, selling shares, or exiting a business investment, knowing your exact tax liability empowers you to make informed financial decisions and maximize your returns. This comprehensive 2026 guide explains everything about capital gains tax in South Africa, from how CGT works and what triggers it, to calculating your exact tax liability, claiming exclusions, and using strategies to minimize what you owe. By the end, you’ll have complete clarity on CGT and the confidence to navigate property and investment sales with precision.

What is Capital Gains Tax (CGT) in South Africa?

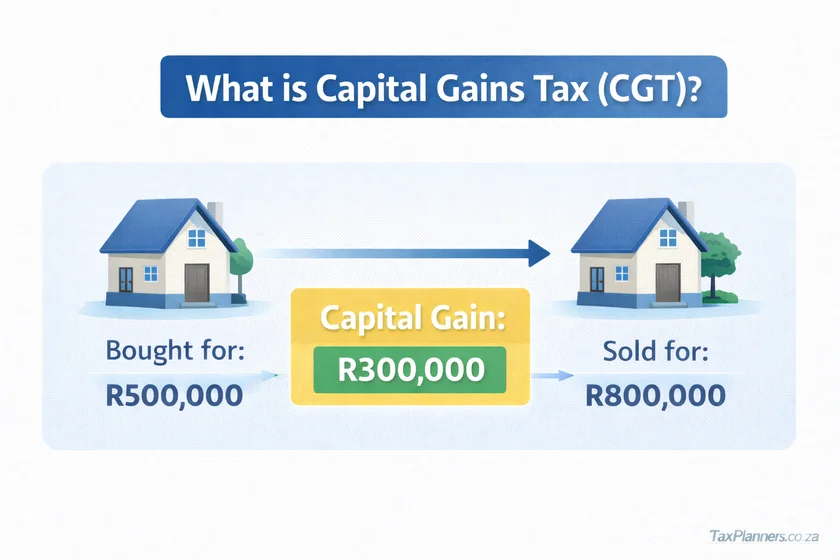

Capital Gains Tax is not a separate tax but forms part of your income tax. It’s a tax on the profit (capital gain) you make when selling or disposing of an asset for more than its base cost. CGT was introduced in South Africa on 1 October 2001, meaning any assets acquired before this date have special valuation rules.

The fundamental concept is straightforward: if you buy an asset for R500,000 and later sell it for R800,000, you’ve made a capital gain of R300,000. SARS will tax a portion of this profit. However, the actual tax calculation involves several important factors including annual exclusions, inclusion rates, and your marginal income tax rate.

Key Characteristics of CGT

- Not a separate tax: CGT forms part of income tax, so you declare capital gains on your normal tax return (ITR12)

- Lower effective tax rate: Only a portion of your gain is taxed, making CGT more favorable than regular income tax

- Annual exclusions apply: Every individual gets a R40,000 annual exclusion before any CGT is payable

- Special exclusions exist: Primary residence sales benefit from a R2 million exclusion

- Applies to residents: South African tax residents pay CGT on worldwide assets

- Non-residents also liable: Non-residents pay CGT only on South African immovable property

Who Pays Capital Gains Tax in South Africa?

CGT applies to individuals, companies, trusts, and other legal entities. The rates and inclusion percentages differ depending on the type of taxpayer.

Individuals and Special Trusts

- Inclusion rate: 40% of the net capital gain is added to taxable income

- Maximum effective CGT rate: 18% (for those in the 45% income tax bracket)

- Annual exclusion: R40,000 per tax year

- Death year exclusion: R300,000 (instead of R40,000)

Companies and Close Corporations

- Inclusion rate: 80% of the net capital gain

- Effective CGT rate: 21.6% (based on 27% corporate tax rate)

- No annual exclusion for companies

Trusts (Other Than Special Trusts)

- Inclusion rate: 80% of the net capital gain

- Maximum effective rate: 36% (based on 45% trust tax rate)

- No annual exclusion for trusts

2026 CGT Rates Summary

| Taxpayer Type | Inclusion Rate | Maximum Effective Rate |

| Individuals | 40% | 18% |

| Companies | 80% | 21.6% |

| Trusts | 80% | 36% |

What Events Trigger Capital Gains Tax?

CGT is triggered by a disposal or deemed disposal of an asset. Understanding what constitutes a disposal is crucial because even if you don’t receive cash, you may still face a CGT liability.

Common CGT Triggering Events

- Sale of property: Selling a second home, investment property, or commercial property

- Sale of shares: Disposing of shares, unit trusts, or other financial investments

- Donation of assets: Gifting property, shares, or valuable assets to family or others

- Exchange or barter: Swapping one asset for another

- Expropriation: When government or authorities compulsorily acquire your property

- Loss or destruction: Insurance proceeds received for lost or destroyed assets

- Death: Upon death, you’re deemed to have disposed of all assets at market value

- Emigration: Ceasing to be a South African tax resident triggers deemed disposal

- Trust vesting: When assets vest in beneficiaries of a trust

How to Calculate Capital Gains Tax: Step-by-Step Guide

Calculating CGT involves several steps. Understanding each component ensures accurate tax calculations and helps identify opportunities to minimize your tax liability.

Step 1: Determine the Proceeds

The proceeds are the amount you receive (or deemed to receive) from disposing of the asset. For a sale, this is usually the selling price. For donations, it’s the market value on the donation date.

Example: You sell an investment property for R1,500,000. Your proceeds are R1,500,000.

Step 2: Calculate the Base Cost

Base cost is what you originally paid to acquire the asset plus allowable costs. This includes:

- Purchase price of the asset

- Transfer costs and attorney fees when buying

- Costs of improvements and renovations (capital improvements only, not maintenance)

- Estate agent commissions on purchase

- Bond registration costs

- Selling costs: estate agent commission, bond cancellation, compliance certificates

Example: Original purchase price R800,000 + transfer costs R30,000 + renovations R120,000 + selling costs R80,000 = Base cost R1,030,000

Step 3: Calculate the Capital Gain

Capital Gain = Proceeds – Base Cost

Example: R1,500,000 (proceeds) – R1,030,000 (base cost) = R470,000 capital gain

Step 4: Apply the Annual Exclusion

For individuals, the first R40,000 of net capital gains in a tax year is tax-free. This exclusion applies across all your capital gains and losses for the year.

Example: R470,000 – R40,000 (annual exclusion) = R430,000

Step 5: Apply the Inclusion Rate

Only 40% of your net capital gain (after the annual exclusion) is included in your taxable income. This is called the taxable capital gain.

Example: R430,000 × 40% = R172,000 taxable capital gain

Step 6: Calculate Tax Using Your Marginal Rate

The taxable capital gain is added to your other income for the year. You then pay tax on this combined amount at your applicable marginal income tax rate.

Example: If your total taxable income (including the R172,000 taxable capital gain) is R650,000, you fall in the 39% tax bracket. The CGT portion of your tax: R172,000 × 39% = R67,080

Complete Example: Selling an Investment Property

Sarah bought an investment property in 2018 for R1,200,000. She spent R150,000 on renovations and paid R40,000 in transfer and bond costs. In 2026, she sells it for R2,000,000, paying R80,000 in estate agent commission and R15,000 in compliance certificates. Sarah’s annual salary is R450,000.

- Proceeds: R2,000,000

- Base cost: R1,200,000 + R150,000 + R40,000 + R80,000 + R15,000 = R1,485,000

- Capital gain: R2,000,000 – R1,485,000 = R515,000

- Annual exclusion: R515,000 – R40,000 = R475,000

- Inclusion rate (40%): R475,000 × 40% = R190,000 taxable capital gain

- Total taxable income: R450,000 + R190,000 = R640,000 (falls in 39% bracket)

- CGT payable: R190,000 × 39% = R74,100

Sarah’s effective CGT rate on her actual gain: R74,100 ÷ R515,000 = 14.4%

Capital Gains Tax Exclusions and Exemptions for 2026

South African tax law provides several exclusions and exemptions that can significantly reduce or eliminate your CGT liability. Understanding and utilizing these is essential for minimizing tax.

1. Annual Exclusion: R40,000

Every individual and special trust receives an annual exclusion of R40,000. This means the first R40,000 of your net capital gains each tax year is completely tax-free. This exclusion applies annually and resets each tax year (1 March to 28 February).

Strategic tip: If you have multiple assets to sell, consider spreading disposals across different tax years to utilize the annual exclusion multiple times.

2. Primary Residence Exclusion: R2 Million

The sale of your primary residence qualifies for an exclusion of up to R2 million of the capital gain. This is one of the most valuable CGT exclusions available and applies each time you sell a primary residence—there’s no lifetime limit.

Requirements to qualify:

- Must be owned by a natural person (not a company or trust)

- You or your spouse must ordinarily reside in the property as your main residence

- Must be used mainly for domestic purposes

- If owned jointly by spouses, the R2 million is split proportionally (typically R1 million each)

Important exception: If you used part of your primary residence for business purposes (home office) or rented out part of it, the exclusion is apportioned. Only the portion used as a primary residence qualifies.

3. Death Year Exclusion: R300,000

In the tax year that an individual dies, their annual exclusion increases from R40,000 to R300,000. This provides significant relief for estates disposing of assets.

4. Small Business Exclusion: R1.8 Million

Individuals aged 55 or older who sell a small business (or their interest in one) may qualify for a once-in-a-lifetime exclusion of up to R1.8 million of the capital gain.

Requirements:

- Must be 55 years or older at disposal date

- Market value of business must not exceed R10 million

- Assets must have been used mainly for business purposes (more than 50% business use)

- Applies once in your lifetime

5. Personal Use Assets

Assets used mainly (more than 50%) for personal, non-business purposes are completely exempt from CGT. These include:

- Personal vehicles (cars, motorcycles)

- Household furniture and appliances

- Personal jewelry and clothing

- Artwork and collectibles for personal enjoyment

- Boats under 10 meters and light aircraft (under 450kg)

6. Other Exempt Disposals

- Retirement fund benefits

- Long-term insurance policy proceeds

- Gambling winnings and lottery prizes

- Compensation for personal injury or illness

- Tax-free investments under Section 12T

Capital Gains Tax on Property Sales

Property transactions are the most common CGT scenarios for South Africans. Whether selling a primary residence, investment property, or commercial property, understanding the specific rules is essential.

Selling Your Primary Residence

Most primary residence sales face no CGT thanks to the R2 million exclusion. However, certain situations can still result in tax liability:

Scenario 1: Capital gain under R2 million

John bought his home for R1.5 million in 2015. He sells it in 2026 for R3.2 million. After deducting base costs (R1.65 million including improvements and selling costs), his capital gain is R1.55 million. Since this is under R2 million, John pays zero CGT.

Scenario 2: Capital gain exceeds R2 million

Maria bought her home for R2 million in 2010. She sells it for R5.5 million in 2026. Her base cost including improvements is R2.3 million. Capital gain: R3.2 million.

- Primary residence exclusion: R2 million

- Remaining gain: R1.2 million

- Annual exclusion: R1.2 million – R40,000 = R1.16 million

- Taxable capital gain (40%): R464,000

- At 45% marginal rate: R464,000 × 45% = R208,800 CGT

Mixed-Use Property: Home Office or Rental

When you use part of your primary residence for business or rent it out, the R2 million exclusion must be apportioned based on time or floor area used for each purpose.

Example: Time apportionment

David lived in his house for 6 years, then rented it out for 3 years before selling. Total ownership: 9 years. Capital gain: R900,000.

- Primary residence period: 6 years ÷ 9 years = 66.67%

- Primary residence exclusion applies to: R900,000 × 66.67% = R600,000 (fully excluded)

- Rental period gain: R900,000 × 33.33% = R300,000

- Annual exclusion: R300,000 – R40,000 = R260,000

- Taxable gain (40%): R104,000

- CGT at 39% marginal rate: R40,560

Selling Investment or Rental Property

Properties that were never your primary residence receive no special exclusion beyond the standard R40,000 annual exclusion. The full capital gain (after the annual exclusion) is subject to CGT.

Example:

Investment property purchased for R1 million, sold for R1.8 million. Base cost including improvements and costs: R1.15 million. Capital gain: R650,000.

- Annual exclusion: R650,000 – R40,000 = R610,000

- Taxable capital gain (40%): R244,000

- At 41% marginal rate: R100,040 CGT payable

Capital Gains Tax on Shares and Investments

Selling shares, unit trusts, and other financial investments also triggers CGT. The treatment depends on whether you’re investing or trading.

Investor vs. Trader: A Critical Distinction

This distinction is crucial because it determines whether you pay CGT or regular income tax on your gains:

Investor (Capital Asset):

- Holds investments for long-term growth (typically 3+ years)

- Infrequent buying and selling

- Intention is capital appreciation, not regular income

- Benefits from CGT treatment (maximum 18% effective rate)

- Gets R40,000 annual exclusion

Trader (Trading Stock):

- Frequent buying and selling (day trading, active trading)

- Primary intention is to make profit from trading activity

- Treated as business income

- Taxed at full marginal income tax rates (up to 45%)

- No R40,000 annual exclusion

- Can deduct all business expenses

Calculating CGT on Share Sales

Most individual share investors qualify for CGT treatment. Your broker or financial institution will send you an IT3c certificate showing:

- Gross proceeds (what you sold for)

- Base cost (what you paid, sometimes called weighted average base cost)

Example:

Lisa sold JSE-listed shares for R180,000. Her IT3c shows base cost of R120,000. She has no other capital gains or losses this year.

- Capital gain: R180,000 – R120,000 = R60,000

- Annual exclusion: R60,000 – R40,000 = R20,000

- Taxable capital gain (40%): R8,000

- At 31% marginal rate: R2,480 CGT

Strategies to Minimize Capital Gains Tax

Smart tax planning can legally reduce your CGT liability by thousands of rands. Here are proven strategies used by savvy South African taxpayers.

1. Maximize Your Base Cost

The higher your base cost, the lower your capital gain. Keep meticulous records of:

- All purchase costs (transfer fees, attorney fees, estate agent commission)

- Capital improvements (NOT repairs and maintenance)

- Selling costs (estate agent, bond cancellation, compliance certificates)

Example impact: On a R500,000 capital gain, adding R50,000 of forgotten costs reduces your taxable gain by R20,000 (after 40% inclusion), saving R7,800 in tax (at 39% rate).

2. Time Your Disposals Strategically

Spread disposals across tax years to use multiple annual exclusions:

Instead of selling three investment properties in one year (using one R40,000 exclusion), sell one in February 2026, one in March 2026, and one in February 2027. This uses three R40,000 exclusions (saving up to R14,400 in CGT per exclusion at 18% effective rate).

3. Use Capital Losses to Offset Gains

Capital losses can offset capital gains in the same year or be carried forward indefinitely to future years.

Example: You sold shares making a R150,000 capital gain. You also have shares worth R40,000 less than you paid (a potential R40,000 capital loss). By selling these loss-making shares in the same tax year, your net capital gain becomes R110,000 instead of R150,000, saving R16,000 in tax (at 40% inclusion and 45% rate).

4. Spousal Transfers

Transfers between spouses are CGT-neutral (no CGT triggered). You can transfer assets to your spouse who is in a lower tax bracket before disposal.

Example: Husband is in 45% bracket, wife in 26% bracket. By transferring shares to wife before sale, the effective CGT rate drops from 18% to 10.4%, saving 7.6% on the entire capital gain.

5. Consider the Primary Residence Exclusion Carefully

If you own both a primary residence and investment property, consider whether it’s beneficial to move into the investment property for a period before selling to gain partial primary residence exclusion.

Example: Investment property with R1.5 million capital gain. If you move in and make it your primary residence for 2 years before sale (total ownership 10 years), you get primary residence exclusion on 20% of the gain (R300,000), saving up to R54,000 in CGT.

6. Maximize Small Business Exclusion

If you’re 55 or older and selling a business, structure the sale to maximize the R1.8 million small business exclusion. This can save up to R324,000 in CGT (18% effective rate).

Common Capital Gains Tax Mistakes to Avoid

1. Not Declaring Capital Gains

SARS receives information from financial institutions, property registries, and other sources. Failing to declare capital gains can result in penalties, interest, and potential prosecution. Always declare all capital gains, even if you believe they’re under the exclusion threshold.

2. Losing Records of Base Cost

Keep all purchase documents, improvement receipts, and selling cost records for at least 5 years after disposal. Without proof, SARS may disallow costs, increasing your tax liability.

3. Confusing Repairs with Improvements

Only capital improvements add to base cost. Repairs and maintenance cannot be included. Capital improvements add value or extend the asset’s life (new roof, extensions). Repairs maintain existing condition (fixing leaks, repainting).

4. Not Claiming Primary Residence Exclusion Properly

Many taxpayers fail to apportion correctly when property had mixed use. Always calculate the time-based or area-based split between primary residence and other use to maximize your exclusion.

5. Ignoring Valuation Date Values

Assets owned before 1 October 2001 can use valuation date value (time-apportionment basis) to reduce capital gains. Many taxpayers miss this opportunity.

Frequently Asked Questions About Capital Gains Tax

Q: Do I pay CGT if I donate property to my children?

Yes. Donations trigger CGT based on market value at donation date. You’ll also face donations tax of 20% on amounts over R100,000 per year (or 25% over R30 million lifetime). However, spousal donations face no CGT or donations tax.

Q: What if I inherit property? Do I pay CGT?

You don’t pay CGT on receiving the inheritance. The deceased’s estate pays CGT on the deemed disposal (unless it’s a spousal inheritance). You inherit the property at market value on date of death, which becomes your base cost.

Q: Does CGT apply to cryptocurrency gains?

Yes. SARS treats cryptocurrency as an asset subject to CGT (for investors) or income tax (for traders). The same rules and exclusions apply. Crypto-to-crypto swaps also trigger CGT on each transaction.

Q: Can I avoid CGT by leaving South Africa?

When you cease being a South African tax resident (emigration), SARS deems you to have disposed of all assets at market value. This triggers CGT on unrealized gains. There’s an exemption of R10 million in aggregate for individuals, but complex rules apply. Consult a tax advisor before emigrating.

Q: How do I declare CGT on my tax return?

Declare all capital gains and losses on your ITR12 annual tax return. Complete the Capital Gains section showing proceeds, base costs, and calculations. SARS eFiling guides you through the process. File by the annual deadline (typically October for non-provisional taxpayers).

Q: What records must I keep for CGT purposes?

Keep all documentation for at least 5 years after disposal: purchase agreements, transfer documents, improvement receipts, selling costs, IT3c certificates for shares, and proof of payment. Without supporting documents, SARS may disallow costs, increasing your tax.

Conclusion: Master CGT to Maximize Your Investment Returns

Capital Gains Tax doesn’t have to be complicated or scary. With proper understanding and planning, you can minimize your CGT liability and keep more of your hard earned investment profits. The key principles to remember for 2026 are:

- CGT is part of income tax, not a separate tax, you pay it at your marginal rate on 40% of your gain

- Maximum effective CGT rate is 18% for individuals (much lower than income tax rates)

- Utilize all available exclusions: R40,000 annual, R2 million primary residence, R1.8 million small business

- Maximize your base cost by keeping records of all purchase costs, improvements, and selling expenses

- Plan disposal timing strategically to spread gains across tax years

- Use capital losses to offset gains and reduce your tax bill

- Consider spousal transfers if one spouse is in a lower tax bracket

- Always declare capital gains, SARS receives third-party data and non-disclosure carries severe penalties

Whether you’re selling your home, disposing of investment property, exiting shares, or planning retirement asset sales, understanding CGT empowers you to make informed decisions that protect your wealth. Use the capital gains tax calculator to estimate your liability before any major disposal, keep meticulous records throughout ownership, and consider consulting a tax professional for high-value or complex transactions.

Remember: proper CGT planning isn’t about avoiding tax illegally, it’s about using legitimate strategies within the tax law to minimize your liability and maximize your after-tax returns. Start planning today to ensure you know exactly what you owe before you sell.