Every year, thousands of South African taxpayers miss out on tax refunds simply because they don’t understand how the PAYE system works or how to claim what they’re owed. If you’ve been paying tax through your employer’s payroll, you could be entitled to a refund, and we’re here to help you get it. This comprehensive guide explains everything about PAYE tax refunds in South Africa for the 2026 tax year, from understanding how refunds work to calculating your potential refund and filing your claim with SARS.

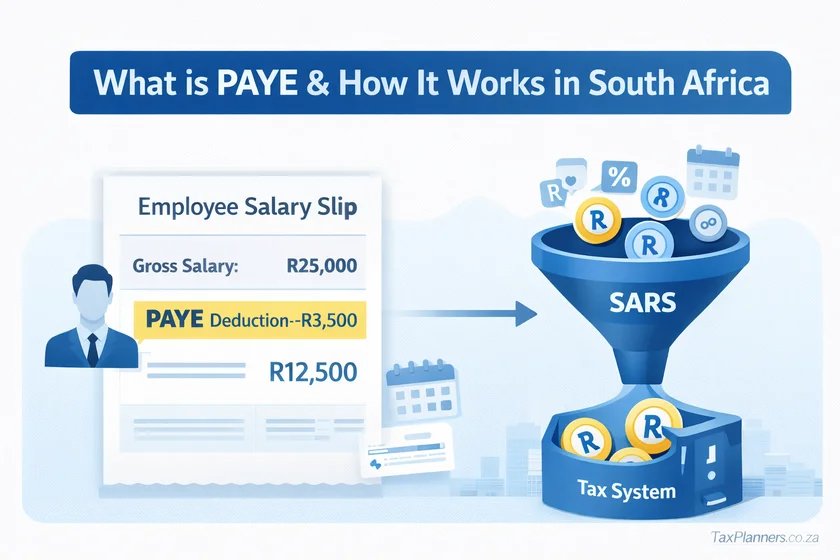

What is PAYE and How Does It Work in South Africa?

PAYE stands for Pay-As-You-Earn, which is the system South African employers use to deduct income tax directly from your monthly salary before you receive it. This tax is calculated based on your gross salary and is paid to the South African Revenue Service (SARS) on your behalf throughout the year.

Understanding PAYE is crucial because it’s not just about the tax being deducted, it’s about ensuring the correct amount is being taken. PAYE operates on a progressive tax system, meaning the more you earn, the higher your tax rate. For the 2026 tax year (1 March 2025 to 28 February 2026), tax rates range from 18% to 45% depending on your income bracket.

2026 PAYE Tax Brackets and Rates

The tax brackets for the 2026 tax year remain unchanged from 2023, which means fiscal drag continues to affect South African taxpayers. Here are the current tax brackets:

| Taxable Income (R) | Tax Rate | Base Tax + Rate Above |

| R0 – R237,100 | 18% | 18% of taxable income |

| R237,101 – R370,500 | 26% | R42,678 + 26% above R237,100 |

| R370,501 – R512,800 | 31% | R77,362 + 31% above R370,500 |

| R512,801 – R673,000 | 36% | R121,475 + 36% above R512,800 |

| R673,001 – R857,900 | 39% | R179,147 + 39% above R673,000 |

| R857,901 – R1,817,000 | 41% | R251,258 + 41% above R857,900 |

| R1,817,001 and above | 45% | R644,489 + 45% above R1,817,000 |

Tax Rebates for 2026: Understanding Your Automatic Deductions

Tax rebates are amounts that reduce your final tax bill after calculations. These rebates create tax thresholds, minimum income levels below which you pay no tax. For 2026, the rebates are:

- Primary rebate: R17,235 (applies to all taxpayers)

- Secondary rebate: R9,444 (for taxpayers aged 65 or older)

- Tertiary rebate: R3,145 (for taxpayers aged 75 or older)

These rebates establish the following tax thresholds for 2026:

- Under 65 years: R95,750 (no tax payable below this)

- Age 65–74 years: R148,217

- Age 75 and older: R165,689

Why You Might Be Owed a PAYE Tax Refund

There are several common scenarios where South African taxpayers end up overpaying tax through PAYE and are entitled to refunds. Understanding these situations can help you identify whether you’re likely to receive money back from SARS.

1. Income Below the Tax Threshold

If you worked for only part of the tax year or your total annual income fell below the tax threshold (R95,750 for those under 65), you likely had unnecessary PAYE deductions. Your employer calculates PAYE based on your monthly salary, assuming you’ll work the full year. When you don’t, or when your income is lower than expected, this results in overpayment.

Example: Tina earned R8,000 per month for three months (R24,000 total for the year). Her employer deducted PAYE each month, but her annual income of R24,000 is well below the R95,750 threshold. When Tina filed her tax return, SARS refunded all the PAYE deductions.

2. Employment Changes During the Year

Changing jobs, periods of unemployment, or salary fluctuations can all result in overpaid taxes. Each employer deducts PAYE independently without knowledge of your other income or employment gaps. This often leads to excessive deductions across the year.

3. Incorrect PAYE Calculations by Employers

Employers occasionally make errors when calculating PAYE deductions. These can include using incorrect tax codes, failing to apply rebates properly, or miscalculating monthly deductions. If your employer deducted more than necessary, you’re entitled to claim that money back.

4. Unclaimed Tax Deductions and Credits

Many taxpayers don’t realize they can claim various deductions and credits that reduce their taxable income. These include:

- Retirement annuity contributions: Up to 27.5% of your taxable income, capped at R350,000 annually

- Medical aid contributions: Supported by medical tax credits

- Additional medical expenses: Excess medical aid contributions and qualifying out-of-pocket medical costs

- Donations to registered charities: Section 18A receipts

- Travel expenses: For business-related travel (if applicable)

- Solar panel rebate: 25% of installation costs up to R15,000 for installations between 1 March 2023 and 29 February 2024

5. Medical Tax Credits Not Applied by Employer

If you pay medical aid contributions independently (not through your employer), your monthly PAYE won’t reflect the medical tax credits you’re entitled to. For 2026, these credits are:

- R364 per month for you as the main member

- R364 per month for your first dependent

- R246 per month for each additional dependent

When you file your annual return, SARS recalculates your tax liability including these credits, often resulting in a refund.

How to Calculate Your PAYE Tax Refund for 2026

Calculating your potential tax refund involves understanding your total income, deductions, tax already paid through PAYE, and any credits you’re entitled to. Here’s a step-by-step guide to help you estimate your refund.

Step 1: Calculate Your Gross Income

Add up all your income for the tax year (1 March 2025 to 28 February 2026). This includes:

- Salary or wages

- Bonuses

- Commissions

- Allowances (car, housing, travel)

- Any other taxable benefits

Step 2: Deduct Allowable Expenses

Subtract any allowable deductions from your gross income. Common deductions include:

- Retirement fund contributions (pension, provident fund, retirement annuity)

- UIF contributions: 1% of your gross salary, capped at R177.12 per month

- Business-related travel expenses (if applicable)

This gives you your taxable income.

Step 3: Calculate Tax Using 2026 Tax Tables

Use the tax brackets listed earlier to calculate your tax liability before rebates. Find which bracket your taxable income falls into and apply the corresponding calculation.

Example calculation: If your taxable income is R516,000:

- Find the bracket: R512,801 – R673,000

- Base tax: R121,475

- Additional tax: 36% × (R516,000 – R512,800) = 36% × R3,200 = R1,152

- Total tax before rebates: R121,475 + R1,152 = R122,627

Step 4: Apply Tax Rebates and Credits

Subtract your applicable rebates from the calculated tax:

- Primary rebate: R17,235 (everyone gets this)

- Secondary rebate: R9,444 (if 65 or older)

- Tertiary rebate: R3,145 (if 75 or older)

- Medical tax credits: R364 × 12 × number of main member + first dependent, plus R246 × 12 × additional dependents

Continuing the example: R122,627 – R17,235 = R105,392 (tax actually owed)

Step 5: Compare to PAYE Already Paid

Check your IRP5 certificate (provided by your employer) to see how much PAYE was deducted during the tax year. If the PAYE paid exceeds your actual tax liability (calculated in Step 4), the difference is your refund.

Example: If PAYE deducted was R110,000 and your actual tax owed is R105,392, your refund would be R4,608.

Using Online PAYE Tax Refund Calculators

While manual calculations help you understand the process, online PAYE calculators can save time and reduce errors. Several reliable South African tax calculator websites offer free tools that automatically apply the 2026 tax tables, rebates, and deductions. These calculators typically require you to input:

- Your monthly or annual gross salary

- Age (for correct rebates)

- Medical aid contributions

- Pension or retirement annuity contributions

- Other deductions

Popular PAYE calculators include TaxTim, Old Mutual’s income tax calculator, and other SARS-compliant tools that are updated annually with the latest tax tables.

How to Claim Your PAYE Tax Refund from SARS in 2026

Claiming your tax refund involves filing an income tax return with SARS. The process is straightforward if you follow these steps and have all required documents ready. SARS has made it easier than ever with online filing options and even auto-assessments for simpler tax affairs.

Important Dates for 2026 Tax Season

Mark these critical dates in your calendar to avoid penalties:

- Auto-assessments: 7 July 2025 (SARS issues automatic assessments for eligible taxpayers)

- Filing season opens: 21 July 2025 (for non-provisional taxpayers who weren’t auto-assessed)

- Deadline for non-provisional taxpayers: 20 October 2025

- Deadline for provisional taxpayers: 31 January 2026

- Trust tax returns: 20 September 2025 to 19 January 2026

Filing late can result in automatic penalties up to 10% of the tax owed, so submit your return well before the deadline.

Step-by-Step Guide to Filing Your Tax Return

Step 1: Register for SARS eFiling

If you haven’t already, register for SARS eFiling at www.sarsefiling.co.za or download the SARS MobiApp. You’ll need:

- Your South African ID number or passport

- Tax reference number (if you have one)

- Valid email address and cellphone number

Step 2: Gather Required Documents

Collect all necessary documentation before starting your return:

- IRP5/IT3(a) certificate from your employer (shows income and PAYE deducted)

- Medical aid tax certificate

- Retirement annuity contribution certificates

- Section 18A donation receipts (for charity donations)

- Bank statements (to verify banking details for refund payment)

- Travel logbook (if claiming business travel expenses)

- Solar panel installation documents (invoice, proof of payment, electrical certificate)

Step 3: Check for Auto-Assessment

From 7 July 2025, SARS issues auto-assessments to taxpayers with straightforward tax affairs. If you receive an SMS or email notification about an auto-assessment:

- Log into eFiling or the SARS MobiApp

- Review your auto-assessment carefully

- If correct and a refund is due, do nothing—SARS will automatically pay it within 72 hours to your registered bank account

- If incorrect or incomplete, file your own return by 20 October 2025 to correct it

Step 4: Complete the ITR12 Form

If you need to file manually (no auto-assessment or you disagree with it):

- Log into SARS eFiling

- Navigate to ‘Returns Issued’ → ‘Personal Income Tax (ITR12)’

- Select the correct tax year (2026)

- SARS will pre-populate information received from employers, medical aids, and banks

- Verify all pre-populated data is correct

- Add any missing information (additional income, deductions, medical expenses)

- Claim all eligible deductions and credits

- Review your return summary to see if you’re owed a refund

Step 5: Submit Your Return

After completing all sections and double-checking your information:

- Review the final assessment summary

- Submit your return electronically through eFiling

- Receive confirmation of submission (save this for your records)

- Wait for SARS to assess your return

Tracking Your Tax Refund Status

SARS aims to pay 90% of refunds within 72 hours, provided your banking details are correct and there are no outstanding issues. You can track your refund status through multiple channels:

- SARS eFiling: Log in and check your refund status on the homepage

- SARS MobiApp: Tap ‘Refund Status’ on the home screen

- SARS WhatsApp: Send ‘Hi’ to 0800 11 7277, then select ‘Refund Status’

- USSD: Dial *134*7277# and select option 3

What Can Delay Your Tax Refund?

Several factors can delay refund processing. Understanding these helps you avoid issues:

- Incorrect banking details: Update your banking information on eFiling before filing

- Outstanding tax returns from previous years: SARS won’t process refunds until all returns are up to date

- Audit or verification: SARS may select your return for additional review and request supporting documents

- Outstanding tax debt: SARS may offset your refund against other tax debts you owe

- Incomplete information: Missing documents or unclaimed deductions can trigger reviews

If your refund is delayed beyond a week, check your eFiling notifications. SARS will usually send a letter explaining the delay and any documents needed.

Common PAYE Tax Refund Mistakes to Avoid

Many taxpayers inadvertently reduce their refunds or delay processing by making avoidable errors. Here are the most common mistakes and how to prevent them:

1. Not Filing Because Income is Below the Threshold

Even if your annual income is below R95,750, you should still file if your employer deducted PAYE. Many people assume they don’t need to file, missing out on refunds they’re entitled to. Always file if any tax was deducted from your salary.

2. Forgetting to Claim All Deductions

Double-check that you’ve claimed all allowable deductions. Commonly forgotten items include:

- Additional medical expenses beyond your medical aid contributions

- Retirement annuity contributions paid independently

- Donations to registered charities

- Home office expenses (for self-employed individuals)

3. Using Outdated PAYE Tables

Always use the current year’s tax tables. Although 2026 tables are unchanged from 2023-2025, using old calculators or information from previous years can lead to incorrect estimates. Verify you’re using 2026-specific resources.

4. Incorrect or Outdated Banking Details

This is the leading cause of refund delays. Before filing, verify your banking details on eFiling are current. If you’ve changed banks or accounts, update this information immediately. SARS cannot pay refunds to incorrect accounts.

5. Not Keeping Supporting Documents

SARS may request proof for any deductions or income you declare. Keep all certificates, receipts, and statements for at least five years. If you cannot provide supporting documents when SARS requests them, your claimed deductions may be disallowed.

6. Missing the Filing Deadline

Filing late triggers automatic penalties that can reach 10% of tax owed. Set reminders well before the 20 October 2025 deadline (or 31 January 2026 for provisional taxpayers). File early if possible, this also speeds up refund processing.

7. Confusing Gross Salary with Taxable Income

Your gross salary is your total pay before deductions. Your taxable income is your gross salary minus allowable deductions (retirement contributions, UIF, etc.). Tax calculations are based on taxable income, not gross salary. Understanding this distinction helps you calculate your potential refund accurately.

How to Maximize Your PAYE Tax Refund

Beyond avoiding mistakes, there are proactive steps you can take throughout the year to increase your tax refund or reduce your overall tax liability.

1. Maximize Retirement Contributions

Contributions to retirement annuities, pension funds, and provident funds are tax-deductible up to 27.5% of your taxable income, capped at R350,000 annually. Increasing your retirement contributions not only secures your future but reduces your current tax burden, potentially increasing your refund.

2. Maintain Medical Aid Membership

Medical aid contributions generate medical tax credits that directly reduce your tax liability. For 2026, you receive R364 per month for yourself and your first dependent, plus R246 per month for each additional dependent. Additionally, out-of-pocket medical expenses exceeding certain thresholds can provide additional tax relief.

3. Keep Detailed Records of All Medical Expenses

Track all medical expenses not covered by your medical aid. These can include:

- Prescription medications

- Dental work

- Optometry services and glasses

- Physiotherapy

- Medical equipment for disabilities

For taxpayers under 65 with no disability, additional medical expenses can be claimed when they exceed 7.5% of taxable income. For those over 65 or with disabilities, all qualifying expenses can be claimed without this threshold.

4. Donate to Registered Charities

Donations to organizations with Section 18A registration are tax-deductible. Ensure you receive a Section 18A receipt for your donations and claim these on your tax return. This benefits both the charity and your tax position.

5. Claim Solar Panel Rebates

If you installed new solar panels between 1 March 2023 and 29 February 2024, you can claim a rebate of 25% of the cost, up to R15,000. This applies to rooftop solar installations at your primary residence. Required documents include:

- Invoice showing total cost, panel count, and wattage

- Proof of payment

- Electrical Certificate of Compliance

- Proof of primary residence (ownership or rental agreement)

6. Review Your Tax Code with Your Employer

Ensure your employer is using the correct tax code and applying all appropriate rebates when calculating PAYE. If you’re entitled to age-related rebates or other credits, verify these are being considered in your monthly deductions.

Understanding UIF and Other PAYE Deductions

Besides income tax, your payslip likely shows other deductions that affect your take-home pay. Understanding these helps you verify your PAYE calculations are correct.

Unemployment Insurance Fund (UIF)

UIF contributions are mandatory for most employees and provide short-term financial relief if you become unemployed. For 2026:

- Employee contribution: 1% of gross salary

- Maximum monthly contribution: R177.12 (capped)

- Employer also contributes 1% (not deducted from your salary)

UIF contributions are deductible expenses that reduce your taxable income, which can increase your tax refund.

Skills Development Levy (SDL)

Some employers also deduct SDL, which funds skills development initiatives. SDL is 1% of your salary but is typically paid by the employer rather than deducted from your pay. Check your payslip to understand all deductions being made.

What If You Owe SARS Money Instead of Getting a Refund?

Not everyone gets a refund. In some cases, your tax return may show you owe SARS additional tax. This typically happens when:

- Your employer under-deducted PAYE

- You have additional income not subject to PAYE (rental income, freelance work)

- You received substantial bonuses that weren’t taxed correctly

- You have outstanding tax from previous years

If you owe SARS money, you can:

- Pay immediately through eFiling, the SARS MobiApp, or your bank

- Arrange a payment plan with SARS if you cannot pay the full amount

- Request a payment arrangement through the SARS Online Query System

Never ignore tax debt. SARS can impose penalties, interest charges, and in severe cases, take legal action including attachment of assets or garnishment of wages.

Getting Help with Your PAYE Tax Refund

If you’re unsure about any aspect of your tax return or need assistance, several resources are available:

SARS Support Channels

- SARS Contact Centre: 0800 00 7277

- SARS WhatsApp: Send ‘Hi’ to 0800 11 7277

- SARS Online Query System: https://tools.sars.gov.za/soqs

- Visit your nearest SARS branch (book an appointment through eFiling)

- SARS website: www.sars.gov.za

Professional Tax Practitioners

For complex tax situations, consider consulting a registered tax practitioner. They can:

- Complete your tax return accurately

- Identify all deductions you’re entitled to

- Handle SARS queries and audits on your behalf

- Provide tax planning advice to minimize future liability

Online Tax Filing Services

Several reputable online platforms offer assisted tax filing services, including TaxTim and similar services. These platforms guide you through the filing process step-by-step and ensure you claim all eligible deductions.

Frequently Asked Questions About PAYE Tax Refunds

Q: How long does it take to receive my tax refund?

SARS aims to pay 90% of refunds within 72 hours for refunds over R100, provided your banking details are correct and there are no issues with your return. Complex returns or those selected for verification may take longer.

Q: Can I get a refund if I’m self-employed?

Yes, self-employed individuals who pay provisional tax can receive refunds if they overpaid during the year. You must file your income tax return (ITR12) and claim all allowable business expenses to maximize your refund potential.

Q: What happens if SARS audits my return?

SARS may select your return for verification or audit, requesting supporting documents for income or deductions claimed. Respond promptly with all requested documents. Audits don’t necessarily mean problems—SARS conducts random audits as part of standard procedures.

Q: Can I claim a refund for previous tax years?

Yes, you can file returns for previous years if you haven’t already. However, you must file all outstanding returns before SARS will process any refunds. There’s a five-year prescription period for claiming refunds—after that, the right to claim expires.

Q: What if my employer didn’t give me an IRP5?

Employers are legally required to issue IRP5 certificates by 31 May each year. If you haven’t received yours, contact your employer immediately. If they still don’t provide it, log into eFiling—SARS receives copies of all IRP5s electronically and this information should be pre-populated in your return.

Q: Does SARS automatically refund me or do I need to apply?

SARS doesn’t automatically refund without a tax return being submitted. If you receive an auto-assessment showing a refund, SARS will pay it automatically within 72 hours. Otherwise, you must file your return to claim your refund.

Q: Can SARS keep my refund to pay other debts?

Yes, SARS can offset your tax refund against outstanding tax debts you owe. Check your Statement of Account on eFiling to see if you have any tax debt before expecting a refund.

Q: What’s the minimum refund amount SARS will pay?

SARS doesn’t pay refunds less than R100. If your refund is below this threshold, it won’t be processed.

Conclusion: Don’t Leave Money on the Table

Understanding how PAYE works and knowing your rights regarding tax refunds can put thousands of rands back in your pocket. The key takeaways for claiming your 2026 tax refund are:

- Always file a tax return if any PAYE was deducted, even if your income is below the threshold

- Claim all eligible deductions including retirement contributions, medical expenses, and charitable donations

- Keep all supporting documents for at least five years

- File before the deadline (20 October 2025 for non-provisional taxpayers)

- Ensure your banking details are correct on eFiling

- Track your refund status and respond promptly to any SARS queries

With tax brackets unchanged since 2023 and inflation eroding purchasing power, claiming every rand you’re entitled to matters more than ever. Use the information in this guide to calculate your potential refund, file your return accurately, and get your money back from SARS.

Don’t let complexity or confusion prevent you from claiming what’s rightfully yours. Whether you file yourself through eFiling, use an online service, or consult a tax practitioner, take action during the 2026 filing season to secure your tax refund. Your financial wellbeing depends on it.